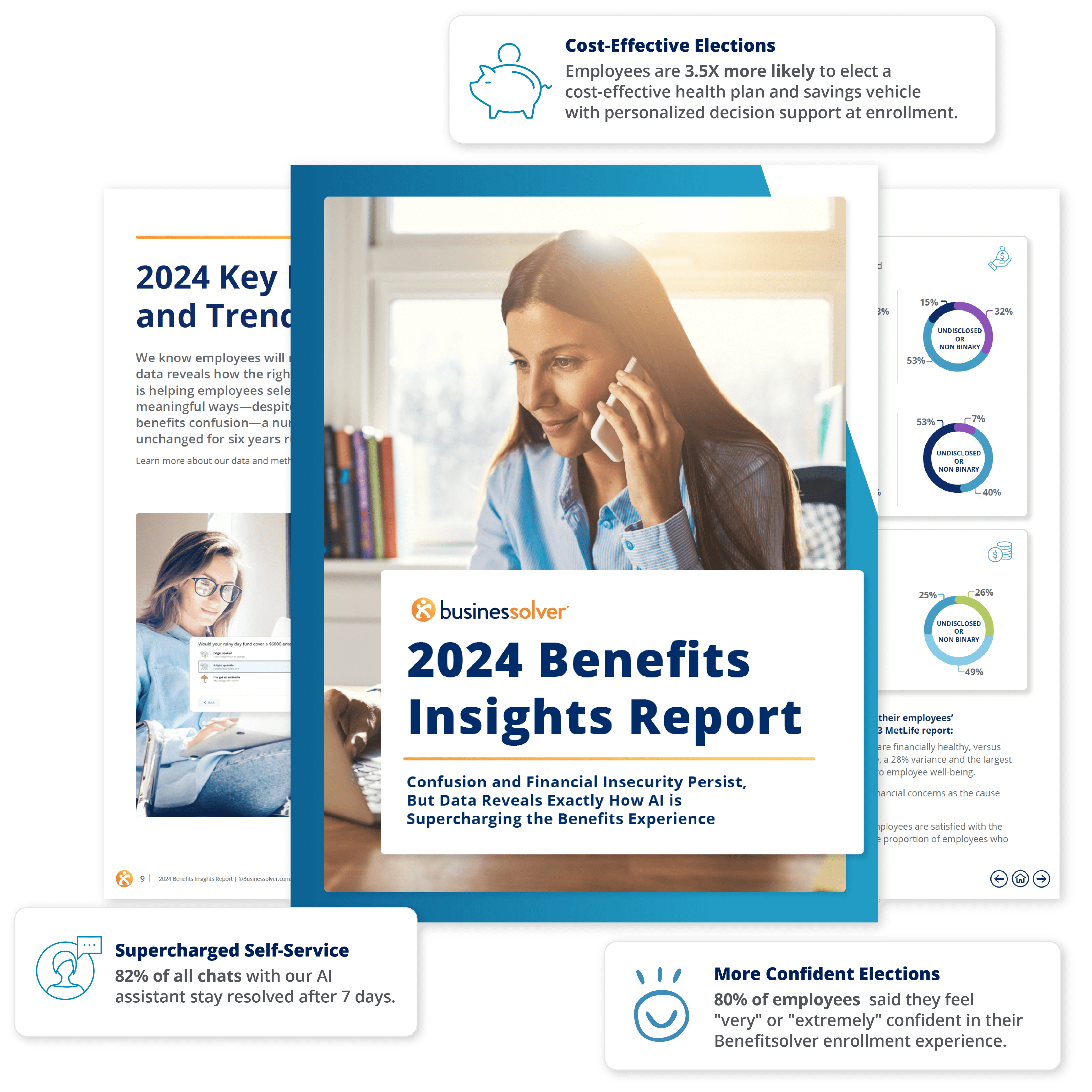

AI is Supercharging the Benefits Experience

Find out exactly how with our 2024 Benefits Insights Report

We analyzed the behaviors and engagement of over 18 million members in our Benefitsolver® platform to reveal how artificial intelligence, personalization, and empathy are reshaping the employee benefits experience and formulating a new model for HR’s benefits strategy.

Our 2024 report will provide you with greater insight into benefits barriers, employee behaviors and trends, as well as the real value of AI in benefits administration to help you confidently deliver a more empathetic benefits experience for your employees while driving down costs and increasing efficiencies for your team.

Read on to download the full report and see how AI supercharges benefits engagement.

See the Data for Yourself

Download the 2024 Benefits Insights reportOur sixth annual report shows that personalization, when powered by empathetic AI and backed by real people, unlocks incredible results in the employee benefits experience. Download our report to read more about how you can deliver an empathetic benefits experience for your employees while driving down costs and increasing efficiencies for your team.