HSA and HDHP Deductible Limits Released for 2021

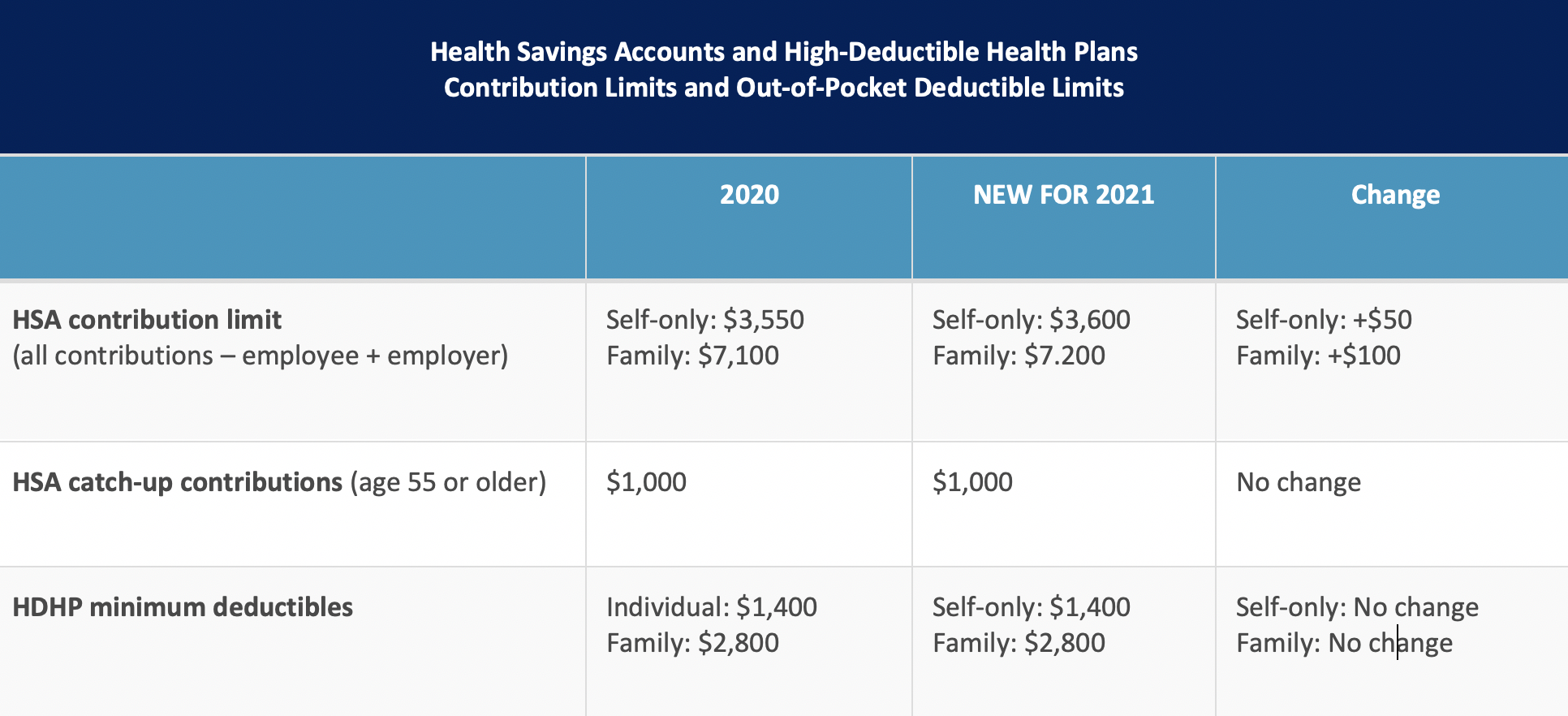

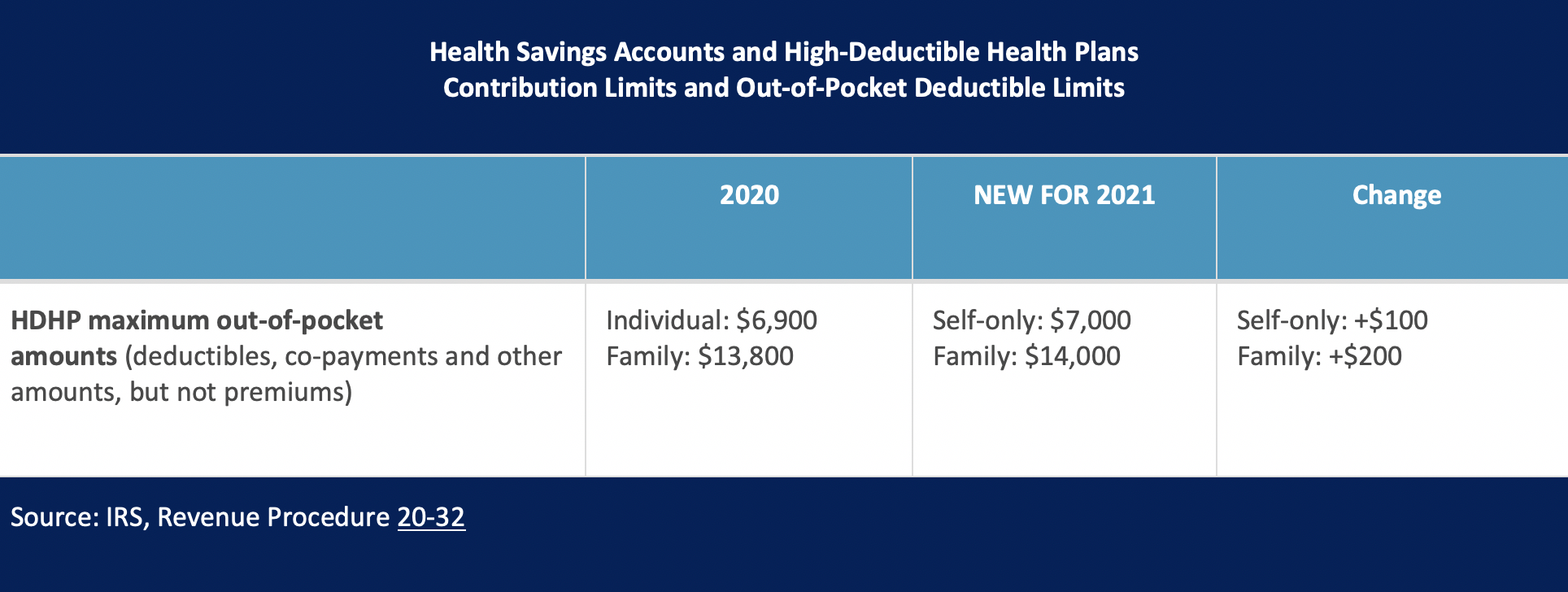

On May 20, 2020, the IRS released its new Health Savings Account (HSA) contribution limits and HDHP deductible limits for 2021.

The new limit for individuals has increased $50 to $3,600 per year, and the limit for family coverage has increased $100 to $7,200 per year. Both increases represent a modest increase to continue growth of the high deductible health plan (HDHP) paired with the HSA benefits model. These increases represent a 1.4% increase over the 2020 limits. Additionally, the catch-up contribution for those over 55 remains the same at $1,000.

Employer strategies around offering HDHPs and HSAs continue to gain momentum.

The 2019 Devenir year-end report shows that there was a 23% year over year increase in HSA assets a 13% increase in total accounts to bring HSAs to just under 30 million accounts nationwide as of January 2020 (29.4 million).

While the initial launch of going to an HDHP plan can feel daunting to implement and communicate for an HR team, the long-term strategy of the HSA as part of the benefits plan has never been more evident than over the last two months.

During this time of unprecedented employment shifts—including furloughs, terminations, and leaves of absence—employees with HSAs have been able to use their accounts to pay for healthcare expenses, such as over the counter medication, telehealth visits, and premium payments. The portability and perpetual roll-over functionality of the HSA continue to make it an integral part of a benefits strategy that helps employees create a safety net for both the short term and the long term.

As we all continue to look to the future and how to help employees weather financial storms, consider the value of communicating the HSA value to your work force or the flexibility of implementing an HSA into your benefits portfolio.

Interested in getting the latest compliance updates directly to your inbox? Subscribe to our blog! {{cta(‘3612abb0-7b35-490b-9520-135440c60722’)}}