Benefits Administration Technology, Powered by People

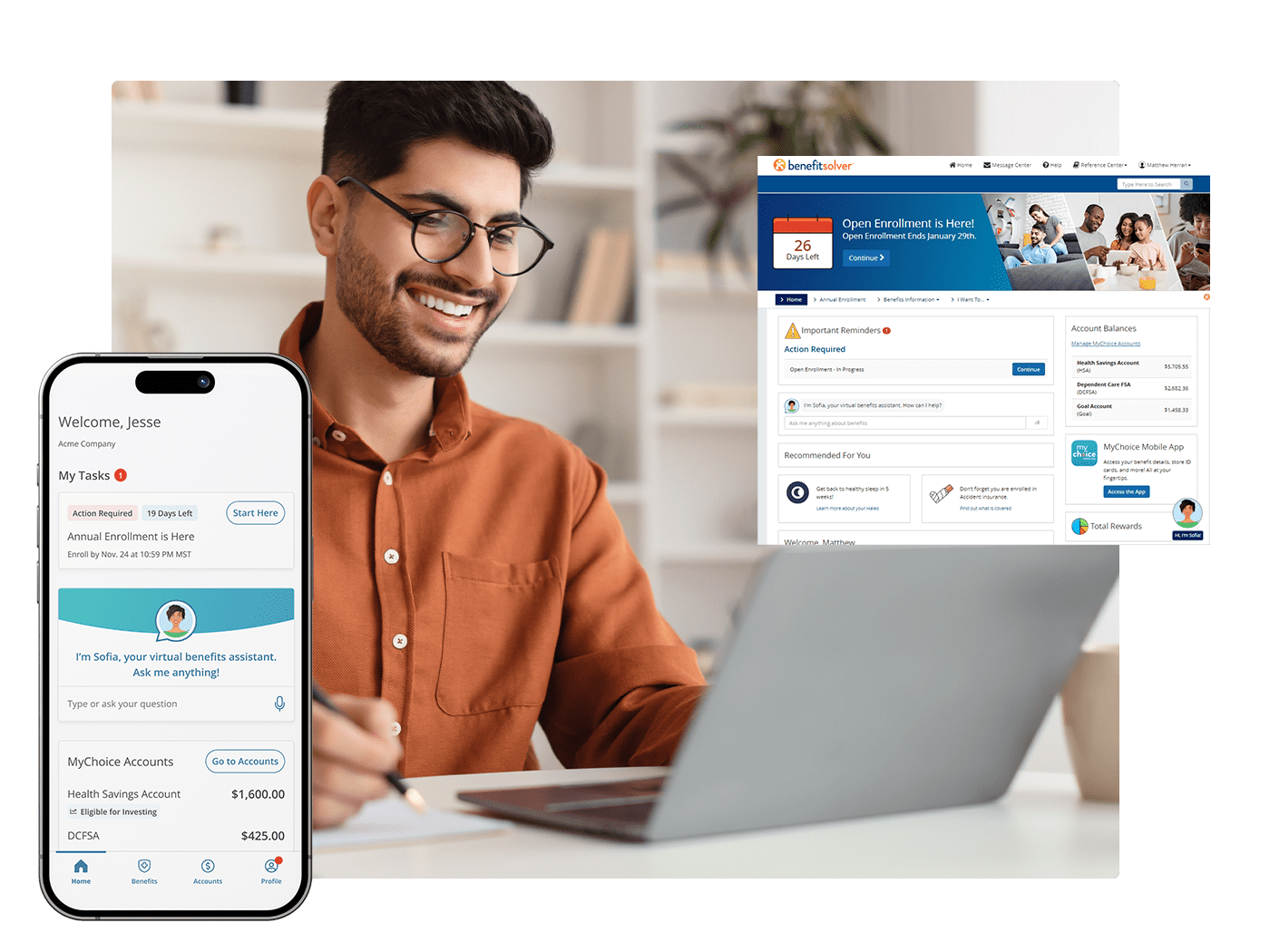

Through Benefitsolver®–our benefits administration and engagement platform–we deliver an industry-leading benefits experience for you and your employees, transforming the annual enrollment experience into a year-round personalized journey. It’s technology powered by people. We call it technology with heart.

Delivering Delight through Benefits

Annual enrollment may be the “big event,” but we understand that delivering a successful benefits program means partnering with our clients and delivering technology that supports both administrators and employees every day of the year.

Your benefits are more than a transaction. Benefitsolver is built to maximize employee understanding and use of all the programs and coverage offered. It is also built to support every facet of benefits management for the important behind-the-scenes work.

An Ecosystem for Benefits Administration

From new hires to active employees to retirees, Benefitsolver can be configured to fit the unique needs of each population you serve. Our continual investment into innovation provides our clients with technology that’s never stale and is ready to meet tomorrow’s demands. Surrounding that technology is a team delivering high-touch service rooted in compassion and deep benefits expertise.

Employees see personalized information that pertains to their benefits, without having to search out their relevant information. Our omni-channel communications framework, embedded within the overall platform, delivers timely messages with actionable steps to help them engage and use their benefits throughout the year.

See how Athletico boosted their employee engagement with integrated benefits communications tools and AI-powered support tools.

See how Athletico boosted their employee engagement with integrated benefits communications tools and AI-powered support tools.

Our market-changing technology is supported by an intrinsic and unwavering responsiveness to your needs today and down the road. Every one of our benefits administration services is delivered with a culture that drives engagement and believes in shared success.

Below are the services we offer within our rules-based, configurable platform:

- Enrollment & Eligibility

- Retiree Administration

- COBRA and Direct Bill Administration

- Billing & Financial Reporting

- Verification Services

- Reporting & Analytics

- Payroll Management

- Communications & Fulfillment

- Consumer-Directed Health Care Administration

Waste Pro transformed their employee benefits experience with Benefitsolver, increasing their enrollment accuracy, year-round employee participation, and more HR efficiencies.

Waste Pro transformed their employee benefits experience with Benefitsolver, increasing their enrollment accuracy, year-round employee participation, and more HR efficiencies.

As part of our mission, we actively monitor the ever-changing legislative, regulatory, and judicial environment so we can proactively respond and ensure our system meets compliance demands. We go the extra step to ensure you’re informed about upcoming changes through our client engagement channels and provide you with the tools and services you need to stay ahead.

Benefitsolver powers the following requirements and services. That means less data movement, reduced manual effort and greater transparency:

- ACA Compliance and Tracking

- QMCSO Administration

- COVID-19 Tracker

- COBRA Requirements

- Transparency in Coverage Compliance

- WCAG Platform Accessibility

Businessolver’s dedication to innovation and intelligence comes from a willingness to invest in new ideas that will define the future of the benefits space. Using our empathy-driven design, artificial intelligence (AI), and machine learning, our clients and their workforce have a transformational experience. As AI continues to make an impact in the HR industry, Businessolver is at the forefront of innovation within the benefits landscape.

Employee health and benefit information is some of your most sensitive data, making benefits administration a compliance minefield. We’ve built a highly secure, SaaS benefits administration platform with multiple layers of physical and technical security measures. Because Benefitsolver is a single-source platform, we reduce unnecessary movement of data between systems, helping to eliminate overall risk. In addition to industry-standard security audits, Benefitsolver is HITRUST certified, the highest level of security certification available for our industry.

However when movement is required, Benefitsolver is built to simplify the integrations with your carriers and vendors. After all, creating connections is at the core of what we do. Our technology ensures employee elections and other relevant information will be automatically transferred to the carriers and third-party platforms without manual intervention.

Schedule a Demo

Learn more about Benefitsolver, our benefits administration and engagement technology.

See it in action